Bind With a Trusted Leader in MVRs for Insurance

Deliver faster, more confident decisions with access to direct, nationwide connections, uniform violation codes and configurable scoring.

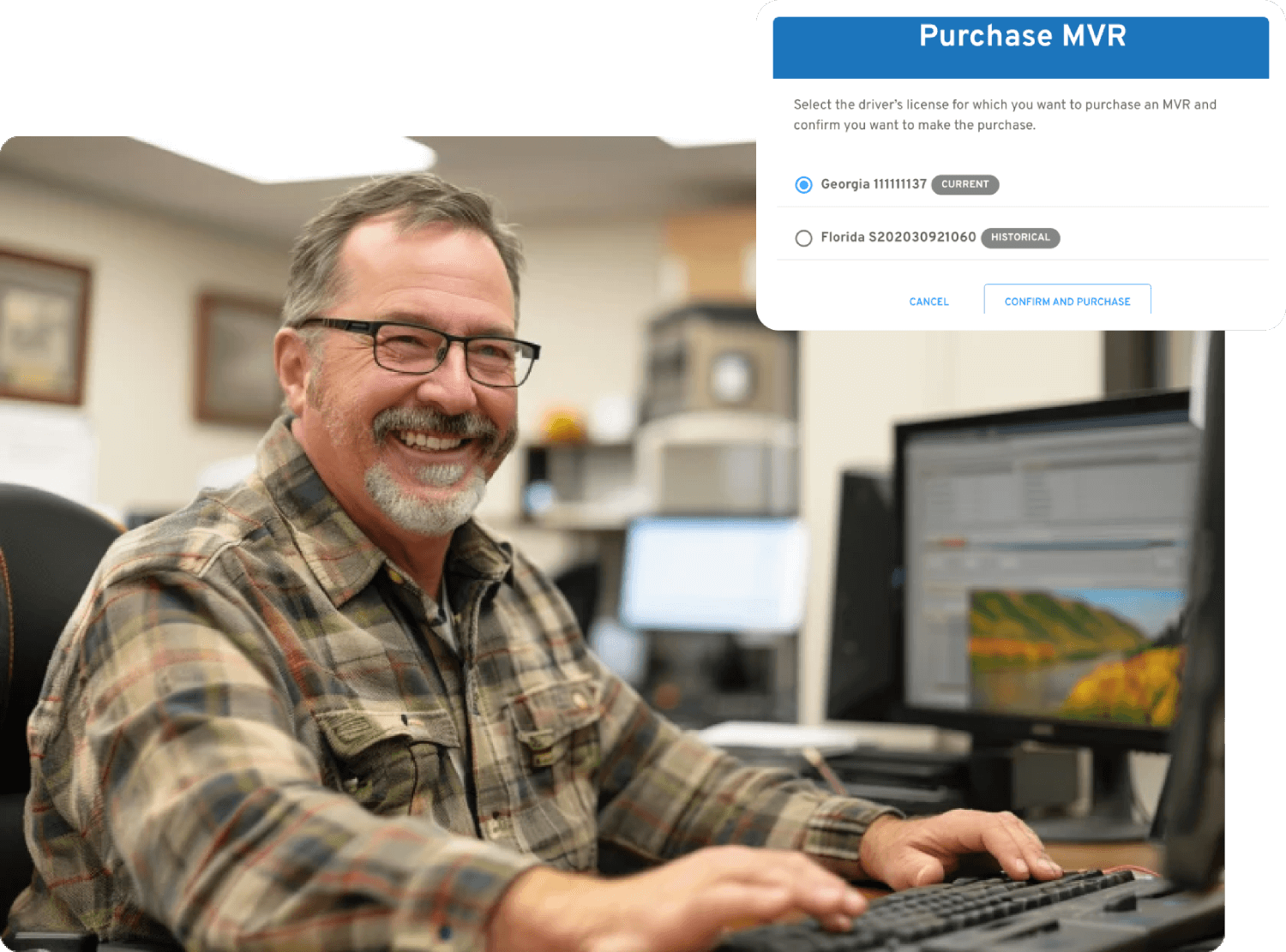

Quote Business Faster

Streamline Renewal Processing

Complete Driver Risk Assessment

SambaSafety provides a full suite of data solutions for accurate underwriting risk assessment. Validate driver identity, pre-screen for violations and target MVR spending strategically to reduce costs and accelerate decisions.

- Target spending on high-risk drivers only

- Validate low-risk drivers without state fees

Learn more about our capabilities for improving underwriting risk assessment.

The Industry Leader in MVR Checks for Insurance

SambaSafety has been the pioneer in MVR solutions for over 25 years, delivering millions of driving records with proven reliability and industry-leading volume.

700M

MVRs delivered over 25 years

50M

MVRs provided annually

60%

Cost reduction in the first year

Why Companies Trust Our MVR Reports for Insurers

Adi Samanta

Risk Manager, Knight Insurance

"We’d never written personal auto before because the rater needs an MVR. Without the right data partner, our product simply wasn’t viable."

Deane Silke

President, Bridger Insurance

"You can’t scale without efficiencies and automation. It’s not possible."

Danny O’Rourke

Chief Procurement Officer

"We have seen impressive results when it comes to reducing violations. It’s been a great partnership and has exceeded our expectations, reducing our total violations by 37%.”

Heidi McCaffray

Sr. Manager of OH&S

"The one thing that really struck me about the training is the quality and detail. It puts you in the driver’s seat of the type of vehicle you’re operating, which we've never had before. It’s interactive, engaging, and keeps your attention."

Understanding Motor Vehicle Records

Explore frequently asked questions and key considerations about SambaSafety's MVRs for insurance.

What is an MVR for insurance?

A motor vehicle report (MVR) is a comprehensive record of a driver's driving history. It provides insurers, specifically underwriters, with details about moving violations, accidents and other traffic offenses. This information is often used to help shape insurance premiums.

Why should insurers prioritize MVR data in their underwriting process?

MVRs provide critical insights that help you accurately assess and price fleet risk:

- Regulatory Compliance Verification: Confirm your insureds meet FMCSA requirements (49 CFR 391.25) for annual MVR checks on commercial drivers—a key indicator of risk management maturity.

- Loss Prediction: Identify drivers with violation patterns that correlate with higher claim frequency and severity, allowing for more accurate pricing and account segmentation.

- Account Quality Assessment: Evaluate whether insureds maintain proper hiring standards and ongoing driver monitoring—factors that directly impact your loss ratios.

- Premium Justification: Use objective MVR data to support rate actions and demonstrate to insureds how driver behavior affects their premiums.

- Competitive Positioning: Better driver data allows you to competitively price good risks while appropriately charging for or declining poor ones.

How much does it cost to run an MVR?

For a complete pricing breakdown of MVR fees by state, you can click here.

What are alternative options to insurance MVRs?

Although MVRs are an essential tool for insurers to understand and price driver risk, new technologies are available that can help assess risk more efficiently without the upfront costs associated with traditional methods.

SambaSafety enables insurers to quickly pre-screen drivers to identify who has violations, then instantly access detailed driving reports through thousands of court and public record sources.

This provides the violation history needed for accurate underwriting decisions without the expense and delay of ordering state MVRs for every applicant.

Blog: Do Annual MVRs Work for Insurers?

Explore the basic fundamentals of MVRs and understand why annual or renewal MVR pulls may not be providing you with the most accurate picture of risk needed to price premiums.