Keep your insurance company profitable with industry-leading data tools.

The cost of insuring drivers has steadily increased over the past decade. Crashes are more expensive, verdicts are higher and there is exponentially more data available. For insurance professionals, this equates to greater operating costs but also greater opportunity for proactivity and personalized customer experience throughout every stage of the insurance policy lifecycle. We can help you keep your costs low and reduce your risk at lead, quote, bind and renew.

You need insight into a driver’s history, enabling you to reduce MVR spend and improve your underwriting performance. With more than 20 years of driver data, we can help you gain that insight.

We know that your focus is to minimize the risk of paying out costly policies. With more drivers on the road today, more expensive cars purchased and higher verdicts derived from negligent lawsuits, you’re forced to ratchet up insurance premiums to compensate.

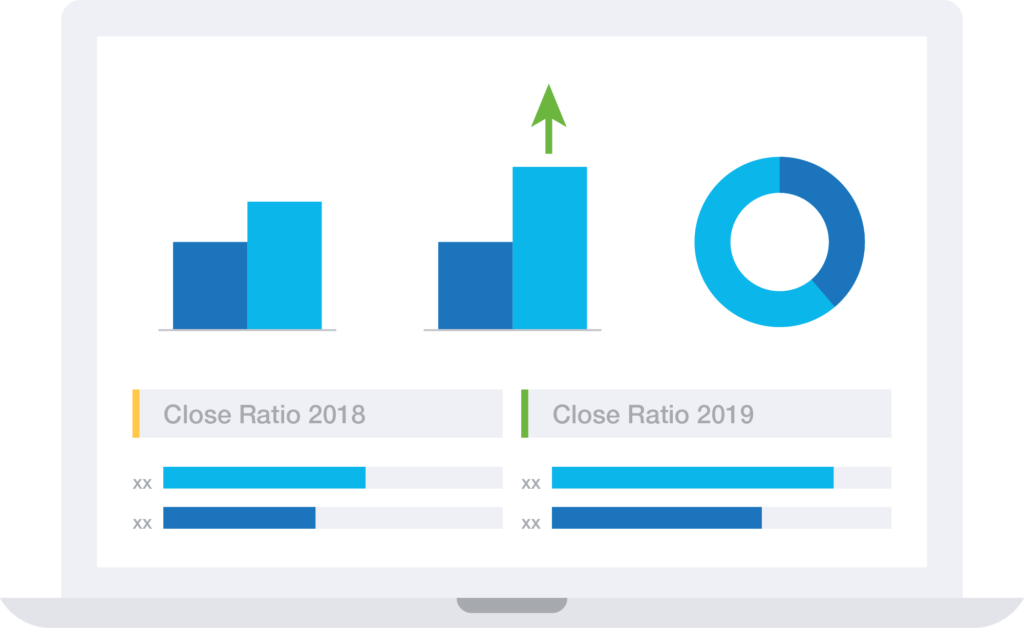

There’s another cost that many companies forget about – the cost of landing those policies in the first place. Between MVR pulls, background checks and the time taken to receive and parse through the data, your time investment can get very high for a quote that you may not be able to bind.

With near real-time access to more than 20 years of comprehensive driver data, we can help you pre-screen leads and more accurately price risk at quote. Through our solutions, we can help you see a 30 to 60 percent reduction in cost compared to traditional MVR pulls.

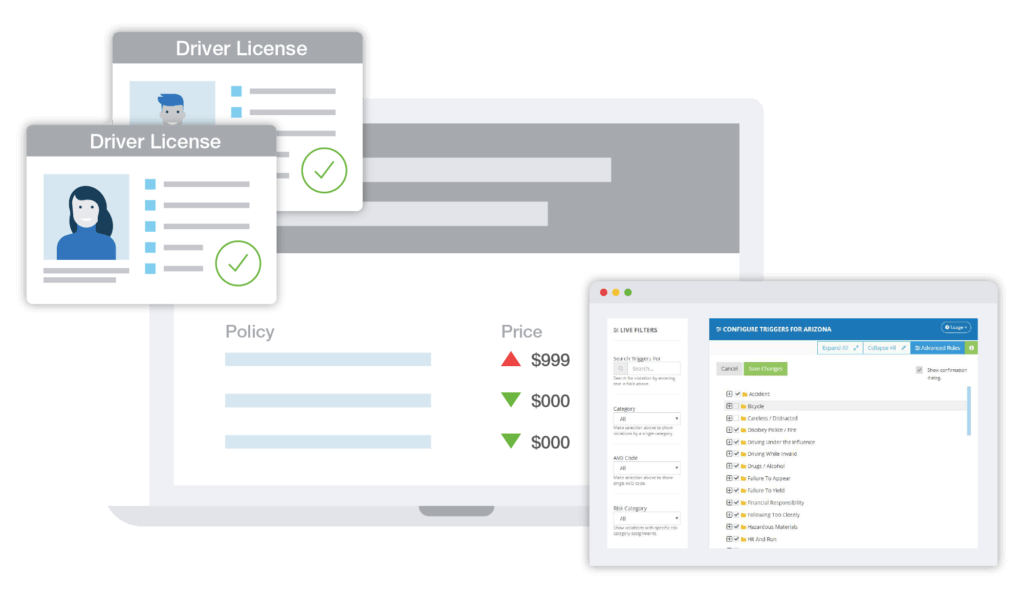

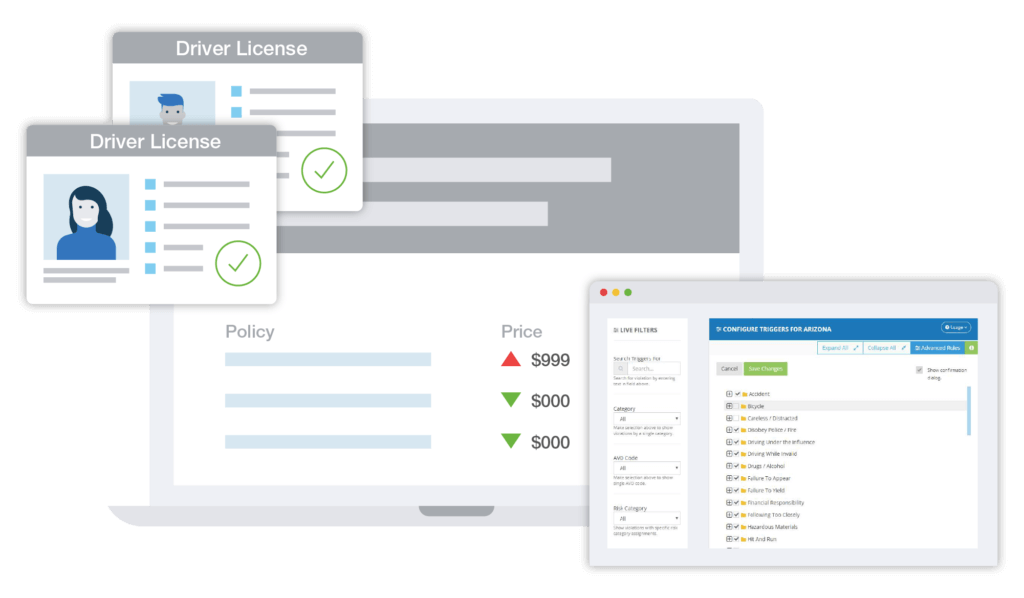

When you create a quote for a new lead, your default solution is to pull (and pay for) a new MVR. Those MVRs can be costly, take time to process and will not always return the complete driver history in question.

We can help you get a more complete picture of your potential customer so that you can spend more time on your most profitable leads. Stop waiting around for expensive document requests and let us pre-screen your drivers.

If one of the drivers you cover incurs a moving violation, it will affect their risk —to both themselves and your company —almost immediately. If you’re going to underwrite a policy for a driver, you need to know about new violations quickly and easily. Configure the underwriting guidelines you want to write against in real-time.